Want to automate your trading by copying the best traders out there, trade by trade? Then copy trading is for you. As you may guess, copy trading allows you to automatically copy professional traders without having to analyze the market by yourself. Here is how copy trading works.

What is copy trading?

Copy trading is a form of investment that involves copying the trades of other traders. It all started in 2005 when the trading service Tradency first offered automated trading but skyrocketed in popularity with eToro and its CopyTrader service. Today, many brokers offer copy trading with a variety of features.

In copy trading, the only research you need to do is to find a profitable trader on a copy trading platform. Most platforms offer a simple way to filter through the trading results of experienced traders, making it easy to find the one that best fits your trading style and risk tolerance.

When a trader that you follow opens a trade, the copy trading platform opens the same trade on your account, automatically. You may also choose how much of your capital you want to allocate to a trader, as well as your total risks per trade.

For example, if a trader opens a buying position on gold with 5% of his trading account size, the same trade would appear in your trading account. You may limit the risk per trade to any level you want in case you’re more risk-averse than the trader you follow.

There are several different types of copy trading, such as mirror trading and social trading. Let’s check the similarities and differences of each of them.

Mirror trading vs copy trading

Mirror trading can be considered a subcategory of copy trading. Unlike copy trading, mirror trading involves copying a specific trading strategy that often comes in the form of automated trading algorithms.

There may be a large group of traders behind an automated trading strategy. In some cases, hundreds of professional traders may have participated in the creation of the automated strategy that you’re following. Instead of copying individual trades, you copy the algorithmic strategy behind the trades.

- Automation: Just like copy trading, mirror trading is fully automated.

- Diversification: Since algorithmic trading strategies are often designed to follow a myriad of market inputs, process them in milliseconds and create a trading signal, they can also lead to more diversification within your portfolio. In addition, many algorithmic strategies trade more than just one market.

Social trading vs copy trading

Another popular type of copy trading is social trading. In social trading, you’re not automatically copying the trades of other traders, but rather exchange ideas and market research with like-minded peers which can benefit your personal trading performance.

Social trading platforms are a great way to learn more about trading from experienced traders. You get to understand why they’re taking certain trades, how they analyze the market, and how they manage the trades.

However, those benefits come with a large drawback: Social trading is not automated. Rather, it’s a platform for exchanging knowledge, research, and ideas, but you have to manually open the trades.

- Time-consuming: Social trading is more time-consuming than both copy trading and mirror trading.

- Education: With social trading, you get to understand why a professional trader takes a trade and what are the exact reasons behind a trade.

How does copy trading work in cryptocurrency?

Copy trading is a universal concept that works in all financial markets. Whether you want to trade Forex, cryptocurrencies, metals, commodities, or stocks, you can do so with copy trading.

Copy trading is a universal concept that works in all financial markets.

Most traders who want to copy the trades of other traders are predominantly interested in the trading performance that they’re able to achieve – not so in the markets that are traded. However, if you want to focus your copy trading solely on cryptocurrencies, you can do so.

Cryptocurrencies are relatively new in the world of finance and professional traders who follow the crypto ecosystem usually have a deep technical knowledge of the products. It makes perfect sense to copy the trades of cryptocurrency traders, especially if you don’t have the necessary experience to trade them on your own.

What are the pros and cons of copy trading?

Copy trading sounds fantastic – you automatically replicate the trades of professional traders without much work and get to enjoy the trading results. However, most of the time, there is no free lunch in the markets. Here are the main pros and cons of copy trading.

Pros:

- Automated trading: The main advantage of copy trading is the ability to automate your trading by following other profitable traders. The only effort you need to make is to find a profitable trader with good trading results, and periodically review the performance of the trader.

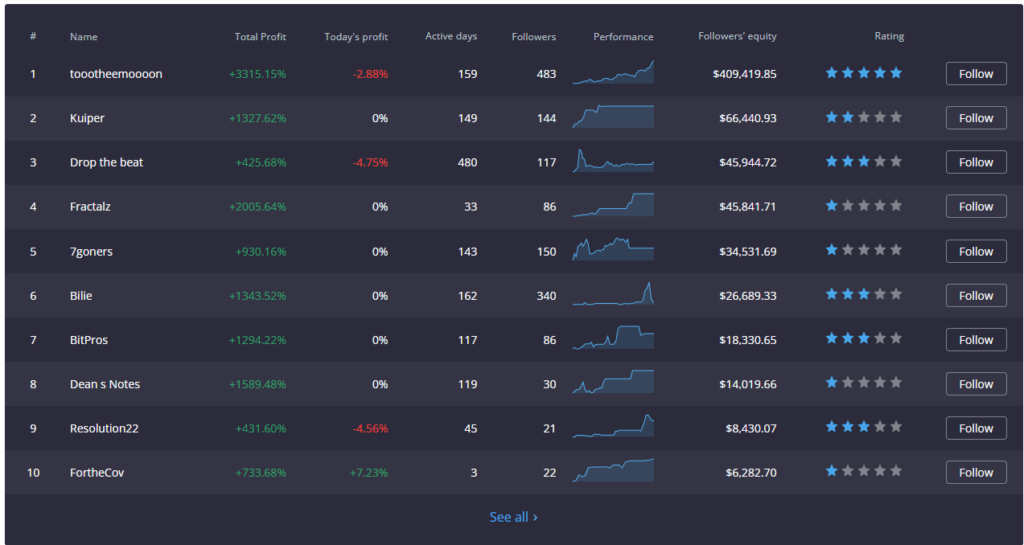

- Finding traders: This leads us to the next advantage of copy trading – the simplicity of finding a profitable trader. Most copy trading platforms allow you to filter through different metrics on their website, including trading results, profit & loss, the average size of winning and losing trades, average risk per trade, reward-to-risk ratios, and more.

- No emotions: better trading: If you’re new to trading, you may have experienced that emotions can have a big impact on your trading results. With copy trading, emotional trading becomes a thing of the past. Since you don’t have to analyze the market and trade on your own, there are no emotions involved.

Cons:

- The (in)ability to control risk – As you may guess, the main drawback of copy trading is that your trading performance is completely dependable on the trading results of the traders you follow. If they make a bad trade, that bad trade will also appear in your trading account. To bypass this major drawback, copy trading platforms allow you to set how much you want to allocate to any single trader, and to pre-determine how much you want to lose on any single trade. You can also interfere and manually close a trade if you feel that the copied trade isn’t as good as it could be.

Is copy trading considered to be profitable?

In copy trading, your trading results fully depend on the trading performance of your followed traders. That is, if you’re following a trader who has a long-term track record of good trades, you’ll probably do well. Here are a few risks that you’re exposed to when copy trading.

Market risk

The most notable risk of copy trading is market risk. Every live trade is inevitably impacted by a variety of market forces that ultimately determine its outcome. In copy trading, market risk is the risk of changing prices in Forex, stocks, interest rates, and other assets that can negatively impact your copied trades.

Don’t confuse market risk with poor trading. Every professional trader has to deal with market risk which can lead to trading losses. However, professional traders usually understand major market forces and try to mitigate market risks as much as possible.

For example, a professional trader may choose not to trade during releases of high-impact news or during illiquid Forex market hours. Markets are often extremely volatile during important news releases, such as monetary policy decisions on non-farm payrolls.

Liquidity risk

The risk of liquidity is often a neglected one in copy trading. Since you don’t have a direct influence on what trades your followed trader will open, you’ll have to deal with liquidity risk.

Liquidity risk is the risk that you (or your followed traders) are unable to close a trade at a certain price, within a reasonable amount of time. If there is no seller on the market, you can’t buy. Conversely, if there is no buyer on the market willing to buy from you, you can’t sell.

Liquidity risk is the risk that you (or your followed traders) are unable to close a trade at a certain price, within a reasonable amount of time.

Liquidity risk usually arises when trading with illiquid instruments, such as exotic Forex pairs, exotic cryptocurrencies, or low-cap stocks. In addition, trading immediately after the market open or before market close can lead to liquidity risks as the number of market participants is still low.

Systematic risk

Last but not least, systematic market risk is a major one that can negatively impact your trades. Systematic risk is inherent to the entire market, which means it can’t be reduced through diversification.

An example of systematic risk is unexpected and sudden news that hits the market by surprise. In 2015, the Swiss National Bank abandoned the 1.20 EUR/CHF peg which sent shockwaves through the markets. Those “black swan” events are almost impossible to predict and can cause large damages to a trading account.

How to copy trade

Everyone can start copy trading by opening an account with a copy trading provider, choosing a trader, and clicking “follow”. Here are a few tips to get started as quickly as possible.

- Open a trading account – Opening a live account with a copy trading provider is the first step of copy trading. The process is quite simple and straightforward. Fill up the registration form, make your initial deposit, and once your account gets approved you can start following profitable traders.

- Choosing a trader – Now that you have a trading account in place, it’s time to choose a trader to follow. This is usually the most time-consuming part of copy trading, but fortunately, most copy trading platforms allow you to quickly filter through important trading metrics and select the best traders out of their database.

When choosing a trader, it’s easy to make the mistake of focusing too much on a trader’s performance. There are other factors that you also need to take into account, such as the risks the trader takes to achieve his results, the traded markets, the average winners and losers, and the winning percentage, to name a few.

- Follow the trader – Once you’ve found an interesting trader, copying his trades is as simple as hitting the “follow” button.

P.S. Some copy trading platforms may ask you to choose how much of your funds you want to allocate to a specific trader, which helps keep your risks under control.

What are trading signals?

Trading signals are indicators that describe what market to trade, at what price level to open a trade, and where to place take-profit and stop-loss levels.

An example of a typical trading signal would be this:

BUY BTC/USD @ $44.750, TP: $46.500, SL: $44.250.

The signal says to buy Bitcoin at $44.750 with a take-profit of $46.500 and a stop-loss of $44.250.

As you may notice, trading signals offer more flexibility than automated copy trading. Although they require you to manually enter the trade in your trading platform, they also offer the flexibility to change the entry and exit prices, or even not to take a trade altogether.

Who are trading signals providers?

Traders who provide trading signals are called trading signal providers. A trading signal provider can consist of one individual trader or a group of traders who distribute their signals to their followers, who then have to manually open the trades in their trading platforms.

Followed traders on a copy trading platform are basically signal providers, with the main difference being that their signals are automatically opened on the accounts of their followers. When choosing a trading signal provider, check their track records and trading style to see if their results fit your goals.

Copy trading strategy

With copy trading, there is no need to have a personal trading strategy. However, having a copy trading strategy may help you in choosing the best traders to follow. Here are the main points of a powerful copy trading strategy.

- Tradeable markets: All of the trades that your followed trader takes will be automatically copied to your trading account. It helps to know what markets the trader trades the most, and whether they align with your trading style and goals.

Traders who predominantly trade tech stocks, for example, could be exposed to risks associated with the technology sector. Traders who trade cryptocurrencies may see larger volatility of their trading performance given the powerful price movements in cryptocurrencies. Choose a trader who trades your preferred markets.

- Risks: How much are you willing to risk with copy trading? Many copy trading platforms allow you to set a maximum loss or to allocate a specific percentage of your trading account to a single trader. In addition, semi-automated copy trading and social trading give you even more control in terms of risk management.

- Market analysis: The advantage of copy trading – not having to analyze markets on your own – can also be a major disadvantage if your followed trader is inexperienced. It’s always a good idea to monitor your copied trades and make adjustments as necessary if market conditions change.

- Leverage: Do you want to copy trades on leverage? Leverage can magnify your profits, but also your losses. Never invest more than you can afford to lose.

Why copy trade with BitCiphex

BitCiphex is an award-winning broker and copy trading provider that welcomes traders of all experience levels. The broker’s Copy Trading module allows you not only to follow the most successful traders but also to learn and gain experience along the way.

Copy trading with BitCiphex is quick, easy, and requires no prior trading experience. All you have to do is open a live account, choose a profitable trader, and you’re ready to go. There is also a powerful filter option that shows the total profit of each trader, the total AUM, and the number of followers, which helps narrow your search for successful traders.

BitCiphex provides access to a wide range of markets for copy trading, including Forex, cryptocurrencies, stock indices, and commodities. And if you’re on the go, you can use BitCiphex’s mobile app to access your trading account and monitor your trades – anywhere, anytime.

Is copy trading a good idea?

Copy trading is ideal for traders who don’t have the time to trade on their own, who don’t have the necessary experience to trade profitably, or who simply want to learn and gain experience while copying some of the most successful traders on the market.

Is copy trading illegal?

In most countries, copy trading is fully legal.

Is copy trading good for beginners?

Copy trading is ideal for beginners. It allows traders without trading experience to follow profitable traders and learn best trading practices along the way.

How much can you make from copy trading?

Your copy trading profits depend on the performance of the traders you follow. Many traders have achieved triple-digit-percentage profits. However, past results are not indicative of future performance.

Is copy trading really profitable?

When following the right traders, copy trading can be extremely profitable. There are many professional traders with multiple years of trading experience who have mastered the skill of trading and risk management. Following those traders can have a significant impact on your bottom line.