By getting involved in EURO STOXX 50 trading, you are getting exposure to the European Union overall. Because of this, trading the index is quite attractive for traders globally, as it simplifies the entire process of benefiting from European growth or volatility.

What is the EURO STOXX 50?

The EURO STOXX 50 is an index that follows 50 blue-chip European companies operating within the eurozone. Components are selected from the EURO STOXX Index, which includes large, made, and small-cap stocks in the eurozone. Because of this, it follows a wide swath of the European economy.

The index contains stocks from nine of the eurozone countries, including Belgium, Finland, Germany, France, Ireland, Luxembourg, Italy, the Netherlands, and Spain. By representing so many different economies within the European Union, the EURO STOXX 50 has become a very important global benchmark.

The EURO STOXX 50 Companies

The EURO STOXX 50 is of course made up of 50 different companies. This index features prices of 50 of the biggest companies on the wider EURO STOXX Index, which includes large, mid, and small-cap stocks. The EURO STOXX 50 companies make up roughly 60% of the wider index.

Some of the household names on the index include SAP, L’Oréal, and Linde. Its largest sector is technology, but it does include a significant amount of industrial and consumer names, and therefore provides a nice overall look at the eurozone and its economy.

EURO STOXX 50 trading hours

At BitCiphex, traders can trade the EURO STOXX 50 24 hours a day, Monday through Friday. The ability to trade at any time is a major benefit we offer our traders as it allows them to take advantage of news after hours, be it to benefit from price appreciation or to protect their accounts in the case of bad news. After all, if you were to trade at a traditional brokerage, you are limited to regular business hours and may face a massive gap for or against your position, leaving you rather exposed.

The index trades from 9:05 AM GMT to 22:55 GMT on the futures exchange, but the CFD market allows you to trade well outside those hours.

How Is EURO STOXX 50 Calculated?

The EURO STOXX 50 is calculated using the number of companies in the index, the current price of each star, the free float factor of each dock, the weighting, and more. These are considered in relation to a constant index divisor, with a maximum weighting for a company being 10%. It is a very complex calculation that most people will not be bothered with.

That being said, the most important takeaway is that the pricing of each stock is the biggest factor. This is why some stocks will move the index more than others.

What Drives the EURO STOXX 50’s price?

To profit from trading the EURO STOXX 50, you will need to understand some of the various fundamental factors that can influence the pricing of the index. By paying attention to some of the more important factors, you can increase your odds of success. The market can be influenced by other things, but these are the major influences on the index.

Monetary policy and economic data

Monetary policy has a major influence on stock performance, and that will not be any different in the EURO STOXX 50. Because of this, the actions and statements coming from the European Central Bank should be paid close attention to, although national central banks can have a minor influence on monetary policy influencing a specific country.

As a general rule, the more accommodative the monetary policy is from the ECB, the higher the stocks will go. This is generally thought of as a result of large amounts of capital flowing through the system, looking for some type of return. Furthermore, the “loose monetary policy” allows for more credit creation, and therefore more spending in general. Alternately, if the ECB tightens its monetary policy, that generally leads to struggles in the stock market, and then by extension the EURO STOXX 50.

Economic data has a major influence as well, especially such figures as the Gross Domestic Product, inflationary figures, and exchange rates. The Euro should be followed in the Forex markets, as it can greatly influence profits by the corporations that make up the index.

Individual corporate influence

As the index is made up of 50 separate corporations, some will have more influence than others. Pay attention to the largest companies, and what they have to say about profits. You should be aware of earnings statements or news conferences involving these companies because a handful of these companies can drastically influence where the index goes in the short term.

You should check the individual weighting of companies occasionally because some will have nowhere near the influence as others. Because of this, the market will be like many other indices in the sense that it is not “equally weighted”, and therefore you need to be cautious about specific companies over others.

Sociological and political risks

You should make sure to understand that some risks have nothing to do with the companies in the index directly. For example, the recent coronavirus pandemic hit, stock markets around the world nosedived, including the EURO STOXX 50. There are other examples of turbulence as well, including social unrest and conflicts, such as the one that has happened in Ukraine.

Political risks also can cause noise, especially when there is a lot of uncertainty in an election. Not all elections matter as much as others, and some countries will have an outsized effect on the index in comparison to others. For example, something that happens in Germany or France is much more likely to have an effect on the market than in Finland or Luxembourg.

What Are the Benefits of EURO STOXX 50 trading?

There are a lot of benefits to trading the EURO STOXX 50 at BitCiphex. The simplicity of being able to trade the index both long and short offers a massive amount of possibilities:

- Represents a huge geographic area – By trading the EURO STOXX 50, you are trading 50 stocks from nine different countries in the European region. This allows the trader to diversify by simply clicking one button.

- Highly liquid – The EURO STOXX 50 is one of the most liquid markets that you can trade in the European Union, so getting in and out of your position is easy to do, around the clock. This also allows for “off-hour” trading through the CFD market.

- Simplifies diversification – By trading the index, you are simplifying the overall investing process, not only trading in several large corporations but trading in several national economies at the same time.

- The ability to hedge existing positions – The index can be bought or sold to hedge existing positions in your stock portfolio.

What Are the Drawbacks of EURO STOXX 50 trading?

There are some drawbacks to trading the EURO STOXX 50 Index, so you should be aware of some of the nuances that could come into play:

- Spread out – Ironically, one of its benefits is also one of its weaknesses. Operating in nine different countries can have its own issues, especially when it comes to political concerns.

- ECB – The European Central Bank makes monetary policy for the entire European Union. One of the biggest challenges for the ECB is that not all European economies function the same way.

- Leverage risks – Keep in mind that you are using leverage trading the CFD, so you need to make sure that you keep your risk management and check and understand some of the inherent dangers of leverage.

- Currency risks – Keep in mind that a lot of the companies that make up the index are exporters, so you need to keep an eye on the exchange rate of the Euro. Luckily, at BitCiphex, you can do that by simply clicking from one chart to the other.

How to trade EURO STOXX 50

If you plan on trading the EURO STOXX 50, you have several options as to what type of instrument you plan on using. However, you have to understand that not all investments will be right for all traders. There are significant differences between available markets.

EURO STOXX 50 CFDs

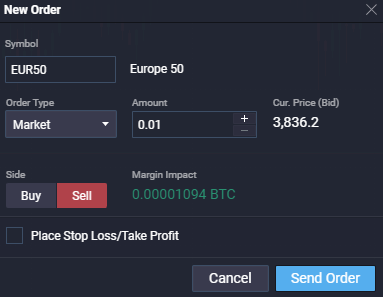

The EURO STOXX 50 can be traded through the CFD market, which is an abbreviation of “contract for difference.” These contracts are derivatives of the underlying index that are easy to trade and allow the trader to enter an agreement to go long or short of the market, without having to go through the exchange itself. It also offers the ability to use leverage, allowing the possibility of exponential profit. The trader enters this agreement understanding that there will be a cash settlement at the close of the trade, be it credit or debit.

EURO STOXX 50 futures

The EURO STOXX 50 can also be traded in the futures market, which is a derivative of the index. Futures markets are on a regulated exchange and have standardized contract sizes. If you have a relatively large account, it does represent an opportunity as they are leveraged products. However, each contract tends to be expensive and of course, there is no way to “split contracts” to adjust trade size granularly.

Quite often, longer-term investors use the futures market to hedge positions that they are exposed to in the stock market. For example, if you believe that the stock markets, in general, are going to fall in the European Union, you may short the futures contract to offset any losses that you may have in your longer-term stock portfolio.

EURO STOXX 50 options

EURO STOXX 50 options are available to be traded, which gives you the right, but not the obligation, to buy or sell the index at a set price on a future date. Most traders decide to settle the difference in cash, much like a CFD. Options do tend to be much cheaper than futures but have a fixed contract size, so it does cause some issues for retail traders as far as being able to granularly position size.

Options have an expiration date, which makes them change value over the course of time. If the index is nowhere near the “strike price” and time is running out, the option starts to lose value rapidly. This makes trading options more of a mathematical calculation than anything else. Understanding Delta, or sensitivity to shifts in the price of the underlying asset, is crucial in being able to succeed in the options market as well.

EURO STOXX 50 stocks and ETFs

Some traders choose to trade the index by purchasing individual stocks or ETFs. The exchange-traded fund is probably the simplest way to take advantage of moves in the EURO STOXX 50 when it comes to a traditional brokerage. It is simply an instrument that owns a basket of stocks, made to mimic the action of the underlying index. That being said, a typical ETF does not have leverage, so it is more or less thought of as an instrument used to invest, not trade or speculate on the market.

Buying individual stocks will bring its own issues, simply because of the expense incurred by trying to purchase all 50 companies, which operate on different exchanges. In the case of the EURO STOXX 50, it simply makes little sense to go this route.

Tips for EURO STOXX 50 Trading

Trading the EURO STOXX 50 might simplify the investment process when it comes to the eurozone, but it does not mean that trading the index and being profitable is a matter of clicking a few buttons. There are a handful of major influences that you need to pay attention to in order to succeed.

- Test your trading plan – Make sure that you test any plan that you have against historical data in this market. Some systems will work swimmingly and one market but fail spectacularly and another.

- Earnings announcements – Make sure you know when earnings announcements are coming out for these companies, especially the largest ones in the index.

- News – Keep an eye on news coming out of the European Union, and make sure that you have timely information. It is a regional index, so understanding what is going on in at least the major economies of Germany and France is crucial.

- Watch your leverage – Make sure you are using an appropriate trade size, as the trading of this CFD is levered. Protecting your trading capital is the most important job you have, so understand that a little bit of leverage can go a long way.

Why Trade EURO STOXX 50 With BitCiphex

Trading the EURO STOXX 50 with BitCiphex is a great way to get exposure to the European economy, as the index follows so many major companies. The EURO STOXX 50 is a market that allows the trader to simplify the entire process of trading in the EU, offering opportunities both long and short.

- CFD market – BitCiphex offers the CFD for EURO STOXX 50, meaning that you can trade in smaller positions if necessary. Furthermore, the CFD market does not force you to trade a standardized contract, meaning that you can trade partial contracts to customize your exposure.

- Leverage – Prime XBT offers 1:100 leverage on the EURO STOXX 50, allowing traders to increase profits with smaller accounts. The growth exponential is something that can greatly shorten the time it takes to build your account up.

- Crypto deposits – BitCiphex accepts crypto deposits and offers the ability to use your crypto to increase wealth while holding them as long-term assets. Furthermore, BitCiphex also offers the ability to stake, allowing interest to be earned on unused crypto.

- World-Class Platform – BitCiphex offers a world-class online trading platform that you can access anywhere you have a browser and an Internet connection. Because of this, trading can be done from anywhere. BitCiphex also provides timely updates and software fixes for the platform.

Which country has the largest waiting in the EURO STOXX 50 index?

While it will fluctuate as the index gets rebalanced, it currently is dominated by France and Germany. The French represent just under 37%, while the Germans represent just over 33%. It is worth noting that the next time he gets rebalanced, we could very well see those countries reverse.

Does EURO STOXX 50 pay dividends?

Yes, there are multiple stocks in the index to pay dividends, and therefore you can receive them if you are holding the index at the dividend date. Over the last several years, the dividend has been anywhere from 2 to 3%. That being said, most traders that are involved in the market are not hanging on to the position for dividends.

What is the best strategy for trading the EURO STOXX 50 Index?

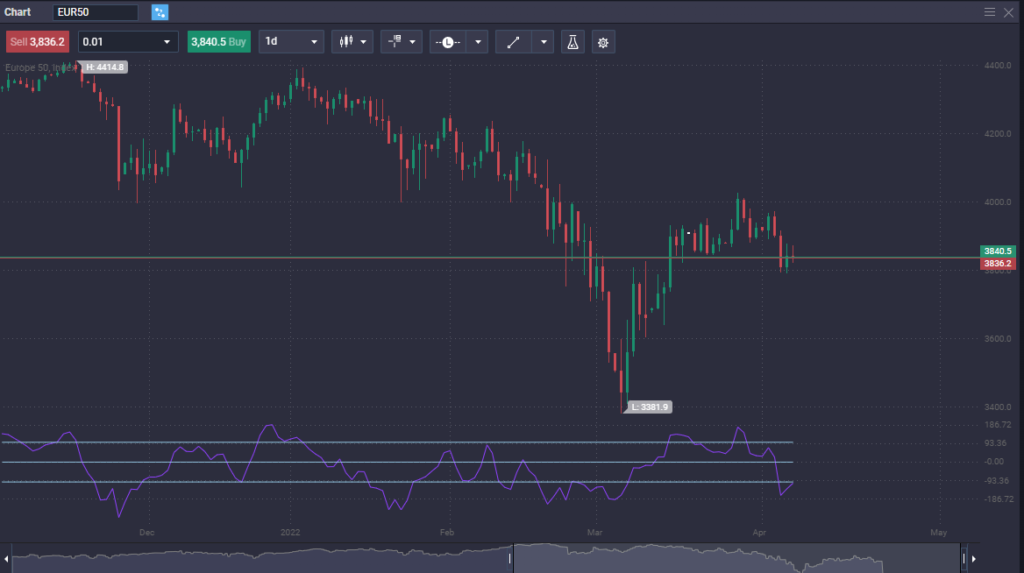

The best strategy for trading the index will be a mix of fundamental analysis, technical analysis, and simple trend following. Indices do tend to trend for long periods of time, so keep that in mind when you are putting a position on.

Why is EURO STOXX 50 helpful to investors?

The EURO STOXX 50 is helpful to investors because it simplifies the entire process of investing in Europe. It also creates instant diversification for your portfolio because you are investing in 50 different companies at the same time. Furthermore, you are investing in nine different countries.