Stock indices are quite easy to trade when using a CFD broker. This gives the trader an ability to benefit from the price fluctuations of an entire list of stocks, instead of picking a singular one. The buying and selling of indices are one of the most common ways to trade financial markets.

What are Indices?

Indices are a way to track the performance of a larger group of assets, giving a standard price for them. Indices measure the performance of stocks that represent a particular part of the market or economy.

Indices measure the performance of stocks that represent a particular part of the market or economy.

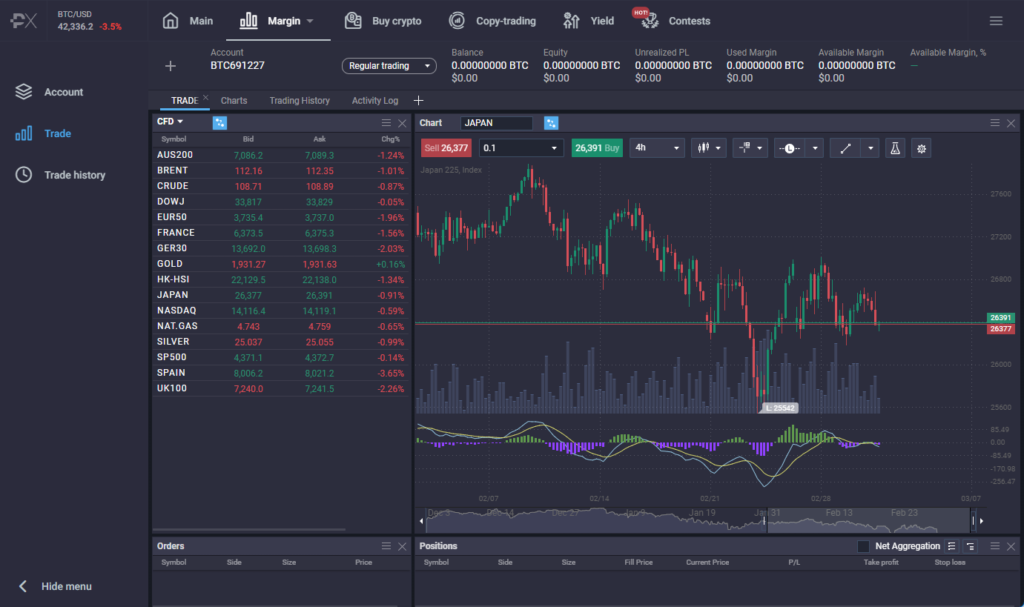

There are numerous types of indices that can cover a wide basket of stocks that represent the larger economy on the whole, or a specific sector, such as technology or transportation. You can find most of the popular indices on the BitCiphex platform. For highly liquid trading, typically traders will focus on the broader indices as they both offer exposure to the overall markets, but also tend to offer more in the way of opportunities on a day-to-day basis.

How are indices calculated?

Stock market index calculations can differ. When you simply add the price of all stocks and divide by that number, it is what is known as an “equal-weighted index.” Most indices that you come across in the modern era do not use this method though.

Most of the time, there are certain companies in an index that have more influence on the market, based on the volume of trading. For example, Apple has a larger influence on indices in the United States than much smaller companies, simply because it accounts for more of the daily volume.

When you take a look at US stock markets, a company like Hewlett-Packard trades much less volume than Apple, so therefore it makes up a smaller percentage of the index. The idea behind this is that it gives you a more accurate picture of how stocks are trading based upon volume. A volume-weighted index is one of the most common versions.

When a handful of stocks makes up 30% of the trading volume (like in the US), it does make trading the index simpler, because if all of the large stocks are going higher, it only takes a few other stocks to join in to drive the price of the index higher.

Indices are recalculated occasionally. As a general rule, if a stock is roughly 5% of the daily volume from the index, it should then be calculated as 5% of the overall price of the same index. On the other hand, if the stock is at the bottom of the list as far as volume is concerned, it will contribute much less.

What is index trading?

Index trading is a form of trading that focuses on a group of stocks to mitigate individual corporate risks. By trading an index, the trader is betting on the movement of the overall market, offering built-in diversity. Index trading has become very popular over the last decade or so, as indices tend to trend for much longer moves than individual stocks.

Index trading is a form of trading that focuses on a group of stocks to mitigate individual corporate risks.

The most common way to trade an index is to bet on a specific country, such as Germany. By trading the DAX 30, you are trading all 30 of Germany’s largest companies at the same time. While some of them may go against your position, others will smooth out the volatility, allowing you to trade based on the specific direction of the economy.

Why trade indices?

There are many reasons to trade indices. One of the main attractions is that it simplifies the process of betting on the direction of the overall stock markets. By taking advantage of the indices, the trader can bet more on the risk appetite of the markets, instead of going through massive amounts of earning reports, news, and balance sheets of particular companies.

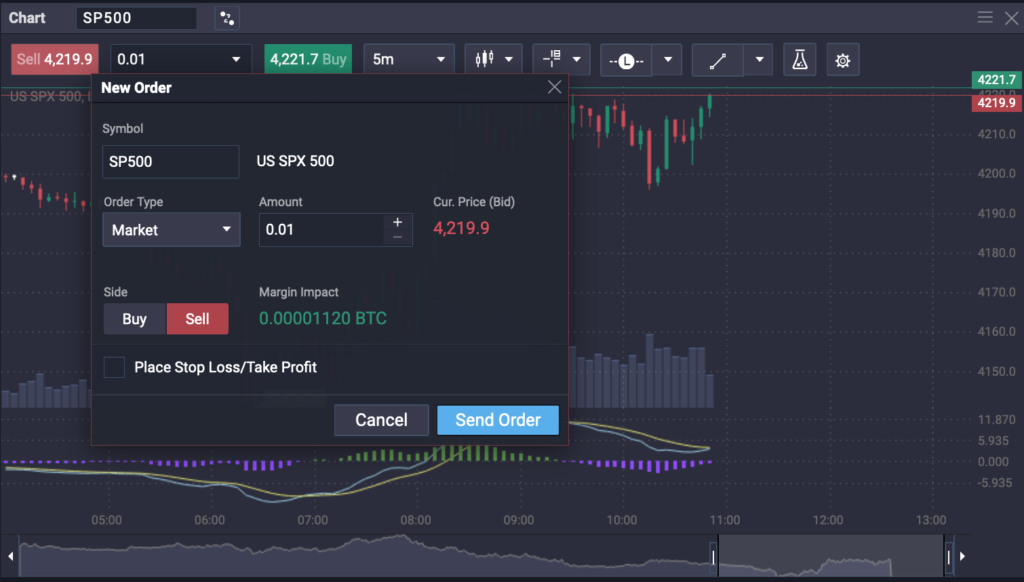

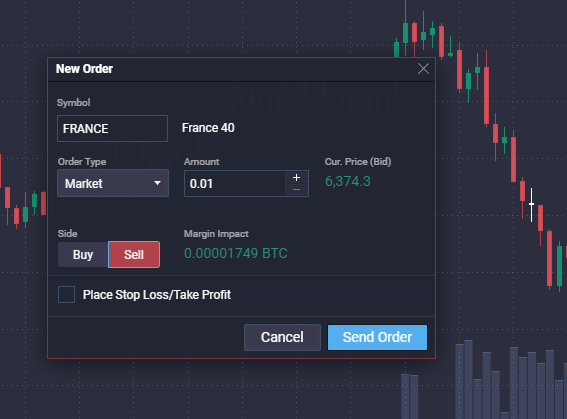

Go long or short

One of the biggest benefits of trading indices is the ability to go either long or short, depending on your trading strategy. Instead of going through the process of borrowing stocks from a broker to sell them to others to “short the market”, a trader simply has to press the “sell” button on the BitCiphex platform to effectively do the same thing. This streamlines the process quite significantly.

You can also buy the index, or “go long”. This allows you to buy the market, on the whole, essentially getting a “piece of the companies” that make up the greater index. By using a long position, the trader is betting on the market going higher, which is much simpler than looking for individual winners.

Trade with leverage

A major advantage to trading indices is that they allow you to use leverage. By using leverage, you can control a large position with a small amount of trading capital. For example, if you were to place a trade in the SP500 index, you could use as much as 100 times leverage. In other words, you can control $100 worth of the contract for every $1 you have in your account available as margin.

You could therefore have control of $100,000 with just $1,000. This means that if there were a 5% gain in the index, your profits would be 500% of your initial investment. However, using 100% of your available leverage is extreme, and should be avoided. The ability to increase your size is a major advantage but needs to be done thoughtfully.

Hedge your existing positions

By trading indices, you can also hedge your existing positions. For example, if you have several stock positions in the United States, you may choose to short the indices through the CFD market. The idea is that if your stocks fall, as a general rule the index should fall as well, and therefore you can benefit from the pullback in your CFD account, mitigating the losses in your stock account.

What are the best stock market indices to invest in?

When it comes to trading indices, not all are going to be equal. The most important thing to pay attention to is that they have volatility and liquidity. Some indices tend to favor one sector of the economy over another, so understanding the differences will be crucial. Here are some of the leading indices, all of which you can trade at BitCiphex.

NASDAQ 100 (US100)

The NASDAQ 100 is an index that consists of 100 of the largest and most heavily traded companies listed on the NASDAQ stock exchange in New York. The NASDAQ 100 includes a wide range of companies, although it has almost no financial entities listed.

The index includes retail, biotechnology, technology, industrials, health care, and a lot of the recent startups that have made such a splash in the markets over the last few years. When traders invest in the NASDAQ 100, they are looking for high-growth companies.

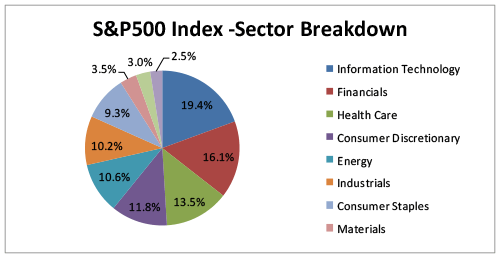

S&P 500 (SP500)

The S&P 500 tracks the largest 500 companies listed on stock exchanges in the United States. The S&P 500 is one of the most widely traded indices in the world and is considered a benchmark for the US economy, as well as the global economy.

The S&P 500 is meant to be a way for traders to measure the entirety of the United States economy. The market will allow traders to get exposure to consumer discretionary, energy, industrials, pharmaceuticals, financial, insurance, airlines, and many other sectors of the overall economy.

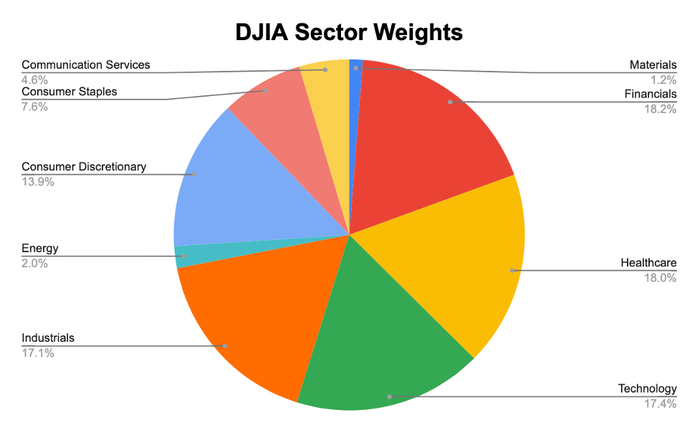

Dow Jones Industrial Average (US30)

The Dow Jones Industrial Average traces its start back to 1896 and is the second oldest index in the United States. (Second only to the Dowell Jones Transportation Average.) It was created by legendary investor Charles Dowell, editor of the Wall Street Journal.

It covers 30 prominent companies listed on stock exchanges in the United States, and unlike many of its other peers, it does not use a weighted average. He uses a simple price-weighted measurement. The use of price-weighted measurements ignores volume and focuses solely on price, adding more weight to those companies that are more expensive than others.

The Dow Jones Industrial Average features a lot of household names that most people would recognize. Managed healthcare, insurance, information technology, pharmaceutical industry, financial services, and many other sectors are covered in this index.

Data source: Yahoo! Finance. Chart by author.

Hang Seng (HK50)

The Hang Seng 50 Index is a stock market index that consists of the 50 biggest Chinese-based companies in the stock exchanges of Hong Kong, Shanghai, and Shenzhen. It used to be solely based upon Hong Kong itself, but as the British relinquished control of the island in 1999, it became a mixed exchange, serving both the island and the mainland.

The Hang Seng 50 Index is a way to play exposure to China overall, and it represents roughly 55% of the Hong Kong Stock Exchange’s value. The index includes financials, consumer goods, construction, energy, telecommunications, and industrials.

FTSE 100 (UK100)

The FTSE 100, which is officially known as the Financial Times Stock Exchange 100, is an index that covers the 100 highest market capitalization companies in the United Kingdom. The index is a play on the UK economy as a whole.

Personal goods, beverages, support services, food producers, mining, telecommunications, financial services, and many other sectors are covered by the index, and it is one of the most widely traded indices by Europeans.

What affects the price of indices

Indices move on a list of different factors, with the most basic one being the earnings of the companies listed. The earnings-per-share, cash flow per share, dividends per share, and a whole litany of other metrics come into the picture.

Indices will also move due to the economic cycle that we are in, and whether or not growth is expected. The better the economic outlook is, typically the better an index will do. However, there are also geopolitical concerns that can come into the picture if you are trading an index that follows a specific country. Typically, it is more or less about “risk appetite” and whether or not traders are willing to put money to work.

How are indices compiled?

Indices have committees that set specific criteria for company stocks to be included. This can be by market capitalization, industry, country of incorporation, or other such criteria. It is common to have multiple criteria, such as market capitalization and industry, or maybe the sector and country of origin.

The committee will have regular meetings to confirm eligibility for the list of companies to remain or be replaced in the index, depending on the rules set in place. If a company is no longer eligible for inclusion, they will either replace them or give them a certain amount of time to come back to compliance.

Index trading history

Indices have been around since the late 1800s. The original indices were published by financial publications, such as the Wall Street Journal. The two original indices were the Dow Jones Transportation Average and the Dow Jones Industrial Average. These were both published in the Customer’s Afternoon Letters, a popular Wall Street publication at the time.

The Standard Statistics Company published its first index in 1923, which was the predecessor to the Standard & Poor’s Index, otherwise known as the S&P 500.

As markets recovered from the Great Depression, The Financial News Ordinary Index was launched in London in 1935, which later became the Financial Times 30, and then the FTSE 30.

Many other indices have been created along the way. The first index fund came in the 1970s, and in 1993 Standard & Poor’s Depositary Receipts (SPDR) S&P 500 ETF was created. This allowed traders the simplicity of trading the entirety of the S&P 500 at once time, without going into the futures markets.

ETFs are simply an extension of the original index concept. For example, the SLV ETF can be thought of as exposure to not only silver, but also many of the silver-related companies that mine, produce, and transport the commodity.

Over the last several years, indices are becoming more and more commonly used to benchmark performance. For example, many funds and firms measure their performance against the S&P 500, or other localized indices.

Traders have shifted focus from individualized stock picking to what is known as “passive investing.” This is when traders buy and hold an index fund or a CFD that mimics the overall performance of a sector of the market.

How much money do you need to trade indices?

To trade indices, you need to put up margin. If you are trading with 1:100 leverage, you will need to put up $1000 to control $100,000 worth of an index. However, using all of your available margin makes little sense, because if the market moves against you, you will be liquidated rather quickly.

One of the greatest advantages of trading CFDs is that you can buy less than the full contract. When you trade a CFD, you can often trade as little as 0.01 lots, instead of the standardized futures contract for an index. This allows accounts of all sizes to get involved.

Choose how to trade indices

The biggest question on how to trade indices to start with is going to be which index you wish to be exposed to. Depending on your needs, it may be a simple matter of hedging a stock portfolio, or you may be wishing to take advantage of volatility in a particular index itself.

When hedging, it will come down to where you already have exposure. If you have a specific part of your portfolio that you are looking to hedge, then it makes the most sense to trade in the opposite direction on the index of the industry, sector, or country in question.

However, if you are trying to benefit from price movement, then you are going to look for a market that is moving in a strong trend, regardless of what part of the world it is in. There can be multiple reasons for this happening, as volatility can be caused by geopolitical concerns, economic announcements, or simple fear and greed.

Decide whether to trade cash indices or index futures

With the advent of CFD markets, deciding on whether to trade a cash index or index futures has become a lot less of an issue, because of the availability to get in and out of the market on a whim. However, there are a few minor differences, as cash indices follow the price action in real-time, while futures are their own market that is trying to predict where an index is going not only in the future but by a specific time.

- Cash indices

A cash index is a calculation of a particular sector of the economy or the market trend in general. By trading the cash index, you are trading what is going on now with the markets, and not necessarily projecting into the future. Cash indices are quite often favored by intraday traders. This is because they are open at the same time as the local markets.

- Index futures

An index future is the market trying to project where an index may go at the end of a specific timeframe. For example, if you are trading the DAX futures for March, you are trying to specify where you believe that the German index is going. Futures are typically used to express either an opinion on further moves or a way to hedge exposure.

- ETFs and shares

Trading an ETF is essentially the same as trading an index, but it may be specific to an industry, market capitalization, country, or a whole host of other possibilities. For example, there is a popular ETF in the United States called JETS, which focuses on the aviation industry. If you are looking to invest in a specific type of asset, an ETF is quite often the solution as it gives you diversified exposure to various companies.

Trading a specific share involves a lot more research, as you need to be aware of balance sheet issues, earnings reports, and of course the industry that the company operates in. Beyond that, some specific shares are going to be much more popular than others and therefore are much more liquid.

Select the index you want to trade

The first step in placing a trade is to determine which index you want to be involved in. If you are hedging, then you will need to trade the index that your stocks are listed on. If you are trying to benefit from price movement, then you will have to decide which index you are most comfortable trading, based upon familiarity, trend, and perhaps most importantly – current volatility.

Decide whether to go longer short

Once you decide what market you are looking to trade, then you need to decide whether or not you believe it is going to go higher or lower. If you are hedging against an existing stock position, the decision is already made for you as you will be going in the opposite direction, protecting yourself from losses. However, if you are looking to profit from this trade, then you need to use some type of analysis to decide which direction you think it is most likely to go. This is where trend, economic, and fundamental analysis come into play.

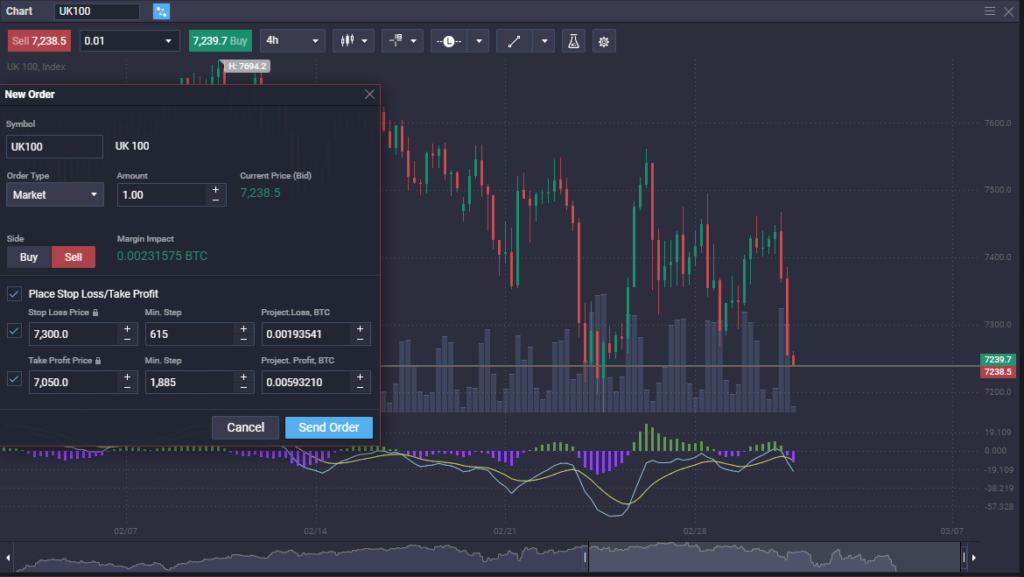

Set your stops and limits

The next step is to set your stop-loss orders and limit orders. While some traders will not put a limit order on as they wish to ride the trend as long as possible, setting a stop loss is crucial. A stop-loss order will protect you if the market goes against you, and also tells you when your trade idea has not worked out.

Whether or not you set a limit order to take profit is going to be based upon your strategy, but many traders will do so and simply go on about their day, knowing that the orders will protect them or collect profits, depending on the outcome.

Open and monitor your trade

Now that you have set your stops and possibly limit orders, it is time to execute the trade. You either buy or sell, and the market does the rest. However, you should monitor your trade from time to time, recognizing whether or not you may wish to add or subtract from the position or adjust your stop-loss or limit orders.

Stock Indices Trading Hours

Please be aware that stock indices do not necessarily trade 24 hours. Below is a chart that explains the hours available to trade each of the indices.

Tips for indices trading

Trading indices is a convenient way to take advantage of a group of stocks or underlying assets at one time. That being said, it is crucial to understand that not all indices are equal-weighted, and therefore you need to understand that specific stocks may have much more influence on the index. Familiarize yourself with the biggest companies of an index, and make sure to monitor those stocks to understand where the index may be going. It isn’t uncommon for just ten stocks to determine where the price goes overall.

As with all markets, placing a stop loss is crucial, and index trading should never be done without using one. The CFD market allows for precise position sizing, so you should take advantage of that as well.

Understanding when the underlying cash index is open is also important because typically that is when you see the most volatility. For example, the US 30 can be relatively quiet during the Asian trading session, but as soon as New York comes online, it starts moving rather quickly.

Why trade indices with BitCiphex?

The most obvious reason you should trade indices with BitCiphex is that you have access to the largest indices around the world, as well as more than 100 other markets. BitCiphex also offers copy trading, allowing you to follow successful indices traders easily through our web-based, world-class platform.

The leverage offered at BitCiphex is also higher than many of our competitors, allowing traders to benefit from movement in the market. By offering such leverage, successful traders can profit immensely from this benefit.

BitCiphex allows traders to benefit from crypto movement, as deposits are done in Bitcoin. Furthermore, there are multiple cross rates in the cryptocurrency markets available with us.

Can I profit from index trading?

Yes, but it takes work. You must be able to find areas of supply and demand, and of course, be able to read the market direction. The most important thing is to pay attention to risk and reward, making sure that you are always aiming for more reward than you are risking.

Are index futures derivatives?

Yes, all futures markets are derivatives regardless of what they are representing.

How can risk be hedged with stock index futures?

If the trader owns stock in the index, trading the index futures in the opposite direction ensures that if their stocks fall, they will be protected because of the gains made in the futures market. This is typically done for those traders that are planning on hanging on to a stock position for a significant amount of time.

What is the maximum leverage I can have trading index CFDs?

Brokers offer leverage according to any regulation that they fall under or simply choose. At BitCiphex, we offer 100 times leverage.

Can I sell futures before expiry?

Yes, you can sell futures at any time you wish to exit the position. It is quite common for traders to “take profits” well ahead of the end date for the contract.