Learning to trade silver can greatly help you diversify your portfolio. It also can give you large gains, as this market tends to be volatile, offering quite a few opportunities. The silver market is a way to play an expectation for inflation, as well as safety.

What is Silver Trading?

Silver trading is the buying and selling of silver to either hedge, speculate, or invest for a longer-term move. Silver trading has grown in popularity over the last several decades, as speculators see silver as a way to hedge against currency loss, inflation, and geopolitical risks.

At BitCiphex, we offer what is known as CFD trading, or contract for difference trading. This means that you can speculate and benefit from price fluctuation without having to take actual delivery of a full futures contract of silver, which would be 5000 ounces. Furthermore, BitCiphex’s CFD market allows for smaller sizes, so that all retail traders can benefit from silver trading.

What is the gold-silver ratio?

The gold-silver ratio is calculated by taking the amount of silver it takes to buy an ounce of gold. Historically, this ratio has fallen somewhere between 15 to 1, or 10 to 1. While this isn’t always the case, it is an indicator that a lot of people will keep in the back of their minds when thinking about silver. For example, if the ratio is 30 to 1, then people will sometimes look to buy silver, as it has signaled that it could be “cheap.”

What Are the Benefits of Silver Trading?

There are a lot of benefits to trading silver, especially if you do it in the CFD market where you can do so responsibly. While you can make a lot of money trading larger contracts, you also have the ability to curb your risk. Silver is a pure price play, much like any other commodity.

- Silver can often have a direct negative correlation to the US dollar.

- Silver can generally move with gold, assuming it is an inflationary play.

- Silver is in great demand longer-term with green technologies.

- Silver markets tend to trade in very technical longer-term patterns.

What Are the Drawbacks of Silver Trading?

While silver markets are wildly popular with traders, there are some drawbacks. It is not unlike any other market, there are both pros and cons to the way the movement of price happens, the structure of the market, and a whole host of other reasons.

- Silver serves a dual purpose, both a precious and industrial metal. Because of this, it can sometimes become very volatile.

- Erratic movement in the silver market can both harm and benefit the trader.

- Silver markets may or may not be influenced by the US dollar depending on the day.

How to trade Silver

Learning how to trade silver can greatly diversify your portfolio, and offers the ability to hedge from inflation concerns and currency degradation. Furthermore, silver markets do tend to stick to a handful of driving factors, and learning these can greatly simplify the process and increase the odds of success for trading it.

Learn about the relationship between silver and gold

Comparing gold and silver dates back millennia, as silver has been thought of as gold’s “little cousin.” Gold is rarer than silver, so it does make sense that silver is cheaper. Both metals are considered to be precious metals though, a safe haven asset, and the form of money.

Going back to the gold-silver ratio, traders will often look at the differential as a signal to start looking to trade silver. As an example, if the ratio is 25 to 1, meaning that it takes 25 ounces of silver to buy an ounce of gold, traders will often look at this as a sign that silver has gotten “cheap.” Conversely, if the gold-silver ratio is 8 to 1, they may choose to buy gold as it would be “cheap.”

In the past, silver was at a fixed ratio of 15 to 1, as it was believed that it would help stabilize global currencies, as well as the global economy. In 1873, it started to fluctuate due to the gold rush that caused an oversupply in the market, and the hoarding of silver.

Factors for silver pricing

Silver is like any other market, with supply and demand being the ultimate deciding factor as to where we go next. Silver tends to be much more volatile than other commodities, as it has quite a few different factors that drive price.

Silver is not only a precious metal, but it is also an industrial one. Silver is used in dentistry, batteries, LED chips, medicine, and a whole host of other industries. This creates steady demand for silver over the longer term.

Inflation is a feature that people pay close attention to, as silver can be a hedge for it. As inflation erodes the value of the currency, silver tends to hold its value. It also is seen as a safe-haven asset, as it has been a form of currency for centuries.

You should also keep an eye on the US dollar because if the US dollar suddenly spikes in value, it can work against the value of silver and vice versa.

Decide on a silver asset to trade

As a trader, you have several different routes you can take in order to benefit from the price appreciation of silver. Each one has its benefits, as well as its limitations. However, understanding the difference between each of these assets is absolutely crucial if you plan on taking advantage of this market.

- Silver stocks: Silver stocks are probably one of the most common ways that investors take advantage of silver markets, however, picking a silver-related company is rather complicated, and you do run company-specific risks. These are typically more geared for longer-term “buy-and-hold” situations.

- Silver options: The options market is one way to play the market, but requires a large amount of capital to get involved in. The options market is a way to speculate on the future price of silver, setting a specific price to take delivery of 5000 ounces per contract.

- Silver ETFs: Exchange traded funds (ETFs) are used quite often to play an entire sector, and silver is no exception. For example, you can buy the ETF named “SLV” through a traditional broker. This is a group of stocks and futures contracts that speculate on the price of silver throughout the entire process.

- Silver futures: The futures market is one of the more common ways to take advantage of this asset, although each standardized contract is 5000 ounces, and therefore gets to be rather expensive. Furthermore, margin requirements are much higher than they are in the CFD world, so it gets expensive to simply open a position. If you have a larger account, this could be feasible though.

- Spot silver: Spot silver is what we are trading at BitCiphex. Furthermore, we offer this market via the CFD market, meaning that you are betting on price movement without having to take delivery of silver itself. You are simply benefiting from the way the market moves. Beyond that, you can also trade in almost any size you need.

Create your silver trading account

To take advantage of the multitude of opportunities that the silver markets offer, you will need to open a silver trading account. At BitCiphex, we make this simple and you can get started rather quickly. The first point of access is confirming an email, allowing you to access the trading platform.

BitCiphex also offers many other markets that you can get involved in, making it a “one-stop-shop” for global trading in commodities, indices, crypto, and foreign exchange.

Your first silver trade

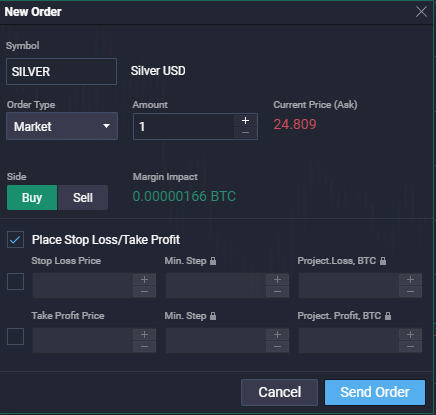

To get started in your silver trading career, you need to open up your first trade. Trading the silver CFD market at BitCiphex is simple. On the “CFD” list in our world-class platform, you simply click trade. You then either buy or sell based upon your analysis, putting in stop losses and limit orders to protect your account.

This should be done after careful analysis and an understanding of where you believe the market is going to go. Remember to practice careful money management and position sizing, because the market can always go in the opposite direction.

Monitor your trade and close your position

Now that you have opened your position, you can keep an eye on where things are going. You can monitor your profit or loss on our platform, but whether or not you do this actively is going to be a product of your timeframe. For example, if you are what is known as a “swing trader”, you are looking at bigger moves in the market and therefore may not pay close attention to the market during the day.

However, if you are an intraday trader, you will be watching the market either constantly or will return to the charts rather often. Either way, you are waiting to see whether or not the market is changing its overall behavior.

Sooner or later, it will be time to close the position. If you have had the market go against you, then your stop loss may get hit. If it does, it informs BitCiphex to close you out at the current market price. This protects your account and is a safeguard if your expectations prove to be wrong.

On the other hand, you may hit your profit target, which is where you set your limit order. Again, BitCiphex will receive the order from your platform to get you out of the market at the best market price. This is what we hope to see when we put a trade on, but it is not always going to be this way.

Another situation may arise. This might be that the behavior of the market is acting rather rationally, or something has changed. In this scenario, the trader will simply exit the position on the platform, which is quite easy to do, as we can look down into the “positions” area of the platform to close out the position.

Tips for Trading Silver

Create your trading plan

Trading silver, or any other market for that matter, demands that you have a trading plan. If you do not, you could find yourself trading based upon a motion, which almost certainly will lead to huge losses. Emotional trading can be counteracted by knowing all important aspects of a trade before it happens.

- What is the purpose of Silver in your portfolio? Hedging? Speculation? Longer-term fundamental reasons?

- How much of your portfolio are you allocating?

- Risk management parameters such as stop-loss, amount of loss is able to withstand, and take profit targets.

- Timeframe of your position.

Understand the fundamental factors of trading silver

Unfortunately, a lot of retail traders believe that silver is simply the “poor cousin” of gold. While the two can move in the same direction at times, the reasoning for a move in the silver market can greatly differ from the gold market. For example, while both can offer a hedge from inflation, silver is a much more industrial metal, meaning that global growth can also drive silver higher, while gold may be shunned in that scenario.

As the world “goes green”, looking for renewable energy, silver is a major component for a lot of the power-producing products. If that is going to continue to be a major theme over the longer term, you should understand that silver may eventually detach from the inflation argument.

Perform analysis

Trades should never be taken “on the fly”, and this requires doing analysis before the “buy” or “sell” button is pushed. Understanding why you are doing something ahead of time and when the position is considered a failure is crucial for longer-term success. You should also understand when it is you believe that it is time to take profit.

The biggest killer of retail accounts is emotional trading, and that can be avoided if you already know what you are going to do before you even press the button. At that point, it will simply be a matter of letting the market do its thing, offering you a result of your analysis.

Start small

With the CFD account, you do not need to trade a massive amount of silver on any one particular trade. Take advantage of the fact that you can do fractional positions, as you begin to “get your feet wet” in this exciting and lucrative market. BitCiphex allows traders the flexibility to trade a reasonable size, regardless of their experience level.

Why Trade Silver with BitCiphex?

The reasons to trade silver with BitCiphex are numerous. While there are other routes to go to take advantage of silver markets, BitCiphex offers convenience with a whole host of other benefits. While some traders may look to stocks, ETF markets, and futures markets, further study will show that trading in the CFD market offers a whole host of advantages. Because of this, BitCiphex is the best option for most retail traders due to:

- World-class online trading platform

- The ability to trade small sizes

- Funding via crypto

- Negative balance protection

- Generous leverage available

Can you make money trading silver?

Yes. Like any other market, there are a lot of opportunities to make a profit trading silver. Understanding the influences and fundamental drivers can greatly improve your odds of success.

Is it easy to sell silver?

Yes. Silver is a highly liquid market that is easily traded around the clock. The market is so heavily traded allows for quick and easy trades.

Is investing in silver a good idea?

It can be. It all comes down to your investment goals. The silver markets are a great way to diversify away from simple stock trading. Silver is also used as a hedge against inflation at times. Furthermore, it is a great way to bet against the US dollar when that correlation makes itself obvious.

What is the best time to trade silver?

While silver markets trade almost 24 hours a day, the best time is generally during the US markets, as the largest futures markets are traded in Chicago. This is when the biggest price movements typically happen.

Can you trade silver on the weekends?

No. Silver is traded during weekdays only.